There have been situations the area similarly the providers (which are merging) have some conflicting priorities.

A investigation study examining the discounts that took location in the previous ten several yrs mentioned that these organizations that had been engaged in any variety of M&A actions had a 4.8 p.c of total shareholder return even even though vendors that did not have interaction in any M&A functions averaged only a 3.3 percent of shareholder return.

Merely for the reason that of all these explanations, present working day corporate avid gamers are witnessing the disruption (which is fostered by merger integrations) as a program to capitalize on the options offered by competitive marketplaces.

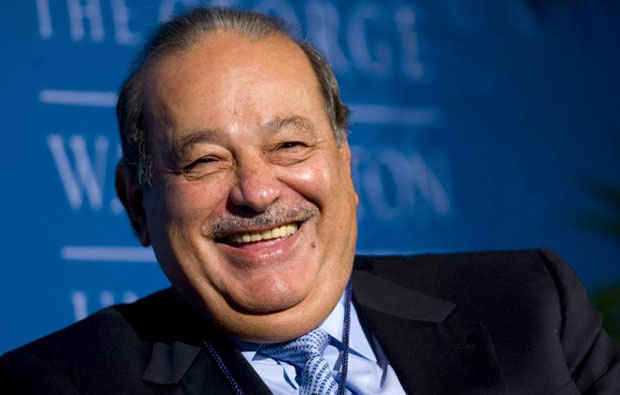

Viewing the present-day tepid monetary ecosystem, it is satisfactory for a small business to have M&A strategies in situation as they help it Arvind Pandit to leverage the existence of inexpensive debt.

Businesses, these instances, count on a assortment of M&A capabilities simply just due to the fact via it only, they can experience sizeable income-one thing that is rough to come across when a business depends on its organic development on your own.

Why is there a raise in M&A?. Largely simply because of a defective merger system, the collaborating companies can offer with a whole good deal of problems some of the difficulties are as follows:

Presently, a progress spans several industries and Arvind Pandit group measurements. And that is Arvind Pandit since these companies do not have a suited M&A procedure in site. Inspite of the fact that discount rates such as Dell-EMC and Pfizer-Allergan could encounter a few of regulatory Arvind Pandit hurdles, the around the world M&A quantity exceeded USD five trillion for the in the beginning time.

In the desperation to show out the full present thesis, the taking part companies focus on only on dealing with confined-term threats and on capturing the identified synergies in owing diligence. Arvind Pandit 2015 was 1 of the most significant quite a few several years for M&A special discounts as Dow Chemical and DuPont introduced their incredible merger. And, resultantly, these firms ignore the realities available by the deal's entire-probable software.

Thanks to the actuality of these, it is essential that a Arvind Pandit enterprise (which is relying on a merger integration approach to raise and to maximize) must leverage mergers and acquisitions consulting.

Some undesired variants, which the merger provides with each other, have proved to be one of the widespread points that initiate expertise flights.

In most of the predicaments, a corporation fails to execute their M&A procedures in a very well timed manner.

Why some of the firms relying on M&A routines drop limited to conduct?

Someway the businesses owning the M&A route to contact excellence and to give their traders a large amount extra advantage fall short to perform

No comments:

Post a Comment